Bear Market Basics 101

NEW YORK CITY – Fasten your seatbelts folks, because we’re in for a bumpy ride. The great bull market we’ve all been riding has suddenly run smack into a big, ornery bear trap on Wall Street. Stock prices are tumbling, investors are grumbling and if you listen closely you can hear the distant lamentations of overtaxed financial advisers being overwhelmed by frantic calls from their suddenly skittish clients.

“It’s crazy out there,” remarked one veteran trader I bumped into at Buck’s Poker Palace, a popular Milwaukee watering hole for investors who like to unwind over a few hands of Texas Hold’em after the closing bell. “We were making money hand over fist just a couple of months ago. Now everyone’s just trying not to get skinned alive.”

The Don’ts: Panicking and Other Rookie Mistakes

Welcome to a bear market, folks. It’s been a long time since we’ve had to deal with one of these bad boys. Maybe you’ve forgotten what they’re all about. Or maybe you’re a fresh-faced investor who’s never had to live through an actual sustained decline in stock prices before. Well, allow me to break it down and explain how the experienced money-mavens navigate these rocky downturns.

The first rule of Bear Market Club is: Don’t panic. I can’t stress this enough. The prices you see flashing on your trading apps are just momentary quotes – not permanent losses. You only get hurt if you let Mr. Market’s mood swings rattle you into making impulsive, ill-timed decisions to buy or sell. Smart investors have a plan and they stick to that plan, not letting emotions like fear and greed shake their discipline. Panic is to investing what smoke is to a fire – it’ll only make things worse.

The Dos: Staying Frosty and Going Contrarian

But the masters also know that the best defense is sometimes a good offense. Bear markets create opportunities for the prepared. With stocks going on sale across the board, it’s a perfect time to pick up shares of quality companies you’ve had your eye on. Or double down on existing positions that you have conviction in for the long haul. As dear Sir John Templeton once quipped: “The time of maximum pessimism is the best time to buy.”

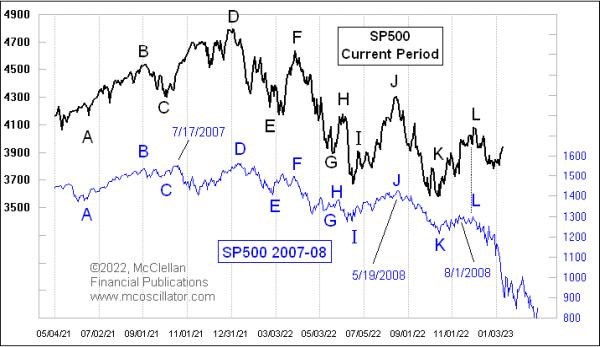

Another trick: Step back and gain some perspective. Take a look at these charts of past mega-bear markets like 1973-74 or 2007-2009.

The markets are always followed by raging bull market comebacks. Markets are cyclical, like the tides. The more things go down, the more powerfully the recovery tends to snap back. The rearview mirror is a powerful tool for reminding you that this too shall pass.

Riding the Waves of Market Turbulence: Navigating Pullbacks and Corrections

On any given day, the stock market might bobble up or down by a mere 1% – just another blip on the radar of capitalism’s endless churn. But sometimes, dear reader, those dips turn into dives, and before you know it, you’re white-knuckling through a bona fide market meltdown.

So, how bad is bad? Well, it depends on which of the three bears you’re tangling with:

- Pullback: If stocks stumble by less than 10%, consider it a pullback – a pesky little pothole on the road to prosperity.

- Correction: But if the market face-plants between 10% and 20%, now we’re talking about a correction. The financial equivalent of a swift kick in the assets.

- Bear Market: And if stocks crater by more than a brutal 20% over a period of time, congratulations! You’re officially in the jaws of a bear market. Buckle up, buttercup.

Now, before you start stuffing your mattress with cash, let’s put these bear attacks into perspective. Over the last 70 years, we’ve endured no less than 13 bear markets. They can last anywhere from a few months to more than three grueling years in extreme cases. The 2008 crash, for instance, mauled portfolios to the tune of over 50%. Ouch.

But here’s the thing: In the grand sweep of history, the overall trend has been onward and upward. The bears may slow our climb, but they’ve never stopped it entirely.

Of course, market movements aren’t always a rational response to economic fundamentals. More often than not, they’re fueled by that most capricious of human forces: emotion. Fear, greed, exuberance, despair – the market is a psychological rollercoaster as much as a financial one.

And both bull and bear markets often start as mere corrections – a natural response to stocks getting a little too big for their britches. But if that correction picks up steam and morphs into a sustained downtrend, well, that’s when the bear really comes out to play.

And boy, does that bear have staying power. It’ll stick around, clawing and gnashing, as long as fear and negativity rule the day. Usually, it takes some kind of positive shock to the system to finally turn the tide – a surprisingly strong quarter of corporate earnings, a geopolitical breakthrough, a charismatic new leader taking the reins.

But make no mistake, bears can also be triggered by economic distress, and only a sustained rebound in the real nuts-and-bolts of commerce can truly lure the bulls back out of hiding.

So, what’s a battered investor to do in the meantime? Grit your teeth, trust the process, and remember that this too shall pass. The market has a funny way of humbling us all, again and again, in its endless cycles of euphoria and despair.

Need More Fortitude? There’s a Book for That

Or do what I sometimes do when things get crazy – crack open the history books. Look at the major events that punctuated markets over time. World wars, debt crises, geopolitical shocks, you name it. Many seemed like extinction-level events at the time. And yet, through all of that mayhem, the steady upward climb of the equity markets and capitalism overall continued unabated like a sturdy mountain path. A little volatility is just the price of admission.

The Elegant Solution: Not Doing Anything At All

There’s also something to be said for just staying put and doing nothing at all. Obviously, pruning the underperformers from your portfolio makes sense. But often the best move during a downturn is no move at all. I have a wise old birddoggy friend who loves to quote the Chinese philosopher Lao Tzu in moments like this: “By acting, one can sometimes make things worse.” A few deep breaths and conscious inaction can be an investor’s most potent weapon.

When the Going Gets Tough, Lean on the Pros

Speaking of conscious actions, here’s one I’d highly recommend: Seek the counsel of seasoned financial professionals. Bear markets are when you really earn the fees you pay to your investment advisor. These men and women have tactical training in areas like asset allocation, tax management, and risk mitigation that the amateur weekend trader simply lacks. An advisor worth their salt will assure you, talk you off the ledge if needed, and make data-driven adjustments to optimize your plan for all conditions.

The Most Important Trait for Surviving a Bear Attack

At the end of the day, enduring bear markets ultimately comes down to having the fortitude and constitution to stay the course. It’s about being unconventional enough to buy when others are desperately selling. It’s having the wisdom to ignore the shrill panicky voices on FinTwit and CNBC and trust your process. As the old Turkish saying goes: “No matter how long the storm lasts, the sea remains salt water.” This too shall pass, and those with perseverance will be rewarded.

Why Bear Markets Are Really Healthy Shake-Ups

None of this is to say bear markets are fun. They are miserable and stressful ordeals. But they are also periodic restart buttons that tend to flush out the speculative excesses and reset valuations to more rational levels. What doesn’t kill your portfolio often makes it stronger. Just ask any old bull who has gotten trapped a few times over the years.

The bears can’t contain the ascent of human ambition and ingenuity forever. That rising tide always finds its way back eventually. In many ways, bear markets are like forest fires – hugely destructive in the short-term, but clearing out the dead underbrush for new shoots of growth to eventually emerge stronger than before.

And let’s face it, without the occasional reset from a grumpy bear, bull markets would just keep raging further and further into dangerous bubble territory. These pullbacks are natural circuit breakers imposed by the universe to prevent the whole system from going full “tulip mania” and cratering entirely.

The Circle of Investor Life

So embrace the circle of investor life, my friends. The bears are an essential part of the cycle, not an evil to be feared and battled against. They are simply snuffing out the excess froth and resetting the stage for the next great bull run. About the only thing more cyclical than the markets themselves is how quickly we all forget the last cycle’s hard-earned lessons about hubris and humility.

That amnesia is already starting to creep back in among the “buy the dip” crowd furiously scooping up every downdraft. Let’s see if they still have that rapacious appetite if this bear really bares its teeth and takes an even bigger bite out of the portfolios.

In the end, the investors who can keep their cool and perspective during the mauling will be the ones left standing, battered but wiser, when the bear finally ambles away and the new bull emerges. It’s a periodic reboot, not a system failure. As the old Rothschild maxim reminds us: “The time to buy is when there’s blood in the streets.” Even if it’s your own.